For Investor

“Advantages of obtaining resident status of the SEZ PPT “Avangard”

Tax benefits for the residents of the SEZ IPT «Avangard»

The cost of renting a Land Plot per year, max = 2% of the cadastral value of the Land Plot per year

Cadastral value of land in the SEZ: from 2.3 to 8.5 million rubles for 2.47 acres

Rent: from 23 thousand rubles up to 153 thousand rubles 2.47 acres per year

-

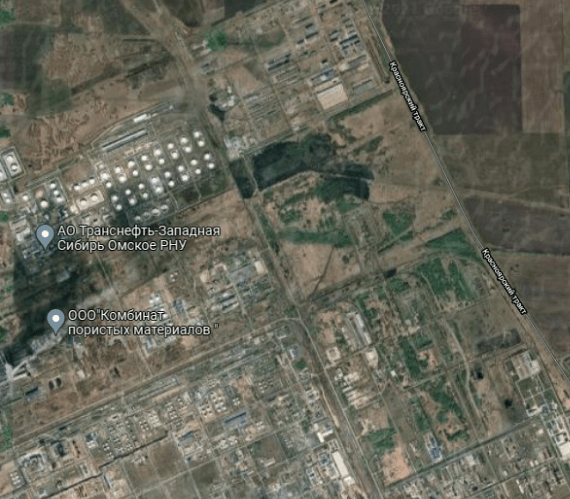

Land plots of SEZ PPT "Avangard"

-

Infrastructure of the SEZ PPT "Avangard"

Information about the sites

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4512 | 61,1 | State (not delimited) | 486 210 521,2 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4589 | 26,0 | State (not delimited) | 154 180 859 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:788 | 4,3 | State (not delimited) | 27 661 080,15 |

| 55:36:030801:789 | 22,6 | State (not delimited) | 147 947 219,38 |

| 55:36:030801:4039 | 22,6 | State (not delimited) | 134 478 950,8 |

| 55:36:030801:4583 | 11,7 | State (not delimited) | 92 942 490 |

| 55:36:030801:4586 | 14,5 | State (not delimited) | 115 161 193 |

| 55:36:030801:4588 | 201,5 | State (not delimited) | 1 602 536 922 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4585 | 34,5 | State (not delimited) | 274 763 711 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4097 | 4,7 | Private | 32 913 896,4 |

| 55:36:030801:4587 | 37,6 | State (not delimited) | 298 837 347 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4591 | 14,9 | Private | 90 232 650 |

| 55:36:030801:49 | 4,8 | Private | 33 727 260,16 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030801:4584 | 16,0 | State (not delimited) | 127 100 943 |

| Cadastral number | Total area, ha | Own | Cadastral value, rub. |

|---|---|---|---|

| 55:36:030115:3233 | 1,8 | State (not delimited) | 15 046 801,42 |

| 55:36:030115:3226 | 5,0 | State (not delimited) | 35 264 938,6 |

| 55:36:030115:3229 | 0,7 | State (not delimited) | 5 660 753,52 |

| 55:36:030115:3022 | 2,6 | Private | 18 999 646 |

| 55:36:030115:3428 | 6,5 | State (not delimited) | 41 019 048 |

| 55:36:030115:3312 | 0,3 | State (not delimited) | 1 953 388,36 |

| 55:36:030115:3020 | 0,1 | State (not delimited) | 700 852,32 |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4512 | 61,1 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4589 | 26,0 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:788 | 4,3 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:789 | 22,6 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:4039 | 22,6 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:4583 | 11,7 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:4586 | 14,5 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:4588 | 201,5 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4585 | 34,5 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4097 | 4,7 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:4587 | 37,6 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4591 | 14,9 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030801:49 | 4,8 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030801:4584 | 16,0 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| Cadastral number | Total area, ha | Electricity | Gas supply | Water supply and sanitation |

|---|---|---|---|---|

| 55:36:030115:3233 | 1,8 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3226 | 5,0 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3229 | 0,7 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3022 | 2,6 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3428 | 6,5 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3312 | 0,3 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

| 55:36:030115:3020 | 0,1 | Up to 20 MgW | Up to 10,000 cubic meters / hour | According to individual specifications |

Land lease cost calculator

Demand to the Resident of SEZ "Avagard"

Commercial organization

- Registration on the territory of Omsk

- Lack of branches and representative offices outside the SEZ

- Implementation of industrial production or logistics activities

- Absence of activities for the development of mineral deposits, with the exception of the development of deposits of mineral waters and other natural healing resources, as well as the production and processing of excisable goods (with the exception of the production of cars and motorcycles, the production and processing of ethane, liquefied hydrocarbon gases and liquid steel).

- The minimum volume of investments, including capital investments (excluding value added tax), declared for implementation by a potential resident of a special economic zone as part of the implementation of an investment project (hereinafter referred to as the minimum volume of investments), must be no less than 120 million rubles upon implementation industrial and production activities, as well as activities in the field of logistics. If the implementation of an investment project is planned on ready-made production sites without the need to provide a potential resident of a special economic zone with land plots and carry out the construction (reconstruction) of production areas necessary for the implementation of activities, the minimum amount of investment must be at least one third of the values specified in this paragraph.

- A resident of a special economic zone must make at least two-thirds of the total investment, including capital investments, within the framework of the investment project in the first 3 years of implementation of the investment project.

- The discounted payback period of an investment project, taking into account the application of special conditions for carrying out business activities in a special economic zone, should be less than 15 years.

“How to become a resident of the SEZ IPT “Avangard”

-

1

Check the compliance of your legal entity with the established requirements, or decide to establish a new company

-

2

Check the compliance of your investment project with the requirements for the volume of capital investments

-

3

Make sure that the planned type of activity complies with those permitted in the SEZ

– industrial production activities: production and (or) processing of goods (products) and their sale;

– logistics activities: provision of services for the transportation and warehousing of goods, including the performance of logistics operations related to the reception, loading (unloading), storage, and sorting of goods;

– technical innovation activities: innovation activities, creation, production and sale of scientific and technical products, creation and implementation of programs for electronic computers, databases, topologies of integrated circuits, information systems, provision of services for the implementation and maintenance of such products, programs, databases data, topologies and systems

-

4

Formulate the project’s needs for land plots, determine the requirements for engineering infrastructure (the amount of necessary resources)

-

5

Prepare a business plan for an investment project in accordance with the requirements of Order of the Ministry of Economic Development of the Russian Federation dated March 23, 2006 No. 75

-

6

Create following package of documents

1) Application

2) Copies of constituent documents

3) Copy of state registration certificate

4) Copy of registration certificate

5) Business plan

-

7

Submit a package of documents to the Ministry of Economic Development of the Omsk Region

Omsk, st. Red Path, 5, room. 51